A Broken System

The story of economic inequality in America.

Housing is unaffordable, wages are too low, healthcare too costly, and the promise of a good paying job has become contingent on a quality education. These issues are tragically widespread in communities across America, from small towns to big cities. There are many different reasons for all of these issues, but they generally stem from some 40 years of harmful legislation.

What exactly is going on here?

Even at a time when Gross Domestic Product (GDP) showed a quarterly increase of 3.1%.1 , the fundamental policy structure in the United States continues to leave workers behind. This is not to deny the positive growth numbers, but rather note that the wealth of this growth is concentrated largely in those already at the top. The average American has been denied their rightful slice of the pie.

GDP is not a measure of a country’s welfare, but rather a straight measure of value for goods and services a country produces in a certain period of time. Thus, a common criticism of GDP is that it fails to capture how the wealth is distributed in addition to what negative externalities may result from the production of this growth. As noted in the Harvard Business Review, GDP “…fails to capture the distribution of income across society – something that is becoming more pertinent in today’s world with rising inequality levels.”2 This was confirmed in a Census report from 2019 showing the real median household income only increasing by 15% between 1979 and 2018, compared to real per capita GDP registering an 89% increase during the same period.3 There is a clear disparity between what the average American is getting and the wealth being produced in the economy.

Why is this happening?

As noted earlier, the policy structure in the United States has been fundamentally fixed so that the average income earner will never realize the full benefits of a growing economy. This mainly started in the early 1980s, when President Ronald Reagan implemented his series of economic reforms (Reagonomics) that set the stage for a spike in inequality. Excessive deregulation, tax policy that exclusively benefited the very wealthy, the diminishing power of labor unions, and some theory that the wealth will “trickle-down” to those at the bottom all led us to where we find ourselves today.

Reagan’s election was fueled by a period of great pain for working people. A strict Federal Reserve policy of high interest rates meant to tame the inflation of the 1970s pushed the economy into an eventual recession. Struggling Americans turned to Reagan for relief and what they got was a plan aimed at curbing the power of government. He began with the 1981 Economic Recovery Tax Act, in which the highest tax rate was reduced from 70% to 50%.4 Reagan himself would eventually backtrack and implement a series of tax hikes the following years, which roughly halved the initial 1981 cuts to avoid bleak deficit forecasts.5 Nevertheless, ERTA set a new standard for fiscal policy in the United States and made tax cuts a political winner.

The idea was that the top income earners would inject this wealth into the general economy through investment. If those at the top had more money, surely it would directly benefit the working class. Instead, “many decided to fund think tanks and hire economists to support their ideology, while others used the windfall to influence politicians and shape laws.“6 Those who benefited from the Reagan tax cuts were never going to pass any great share of wealth down to the rest of us, instead they became absolutely committed to expanding their policy influence at the expense of the middle class.

Reagan also knew America would have to pay for these tax cuts. Naturally, he would call for cuts to social programs in his budget. For example, his 1982 budget proposal included a $44 billion budget cut, with the majority of the targeted programs related to “income security… education, training, employment, and social services.“7 This strategy put a whole lot of faith in Corporate America to provide plentiful jobs with a solid healthcare plan and a good enough salary to keep a roof over your head. Of course, this did not happen as wages have mostly remained stagnant compared to the ever expanding wealth of the elites.

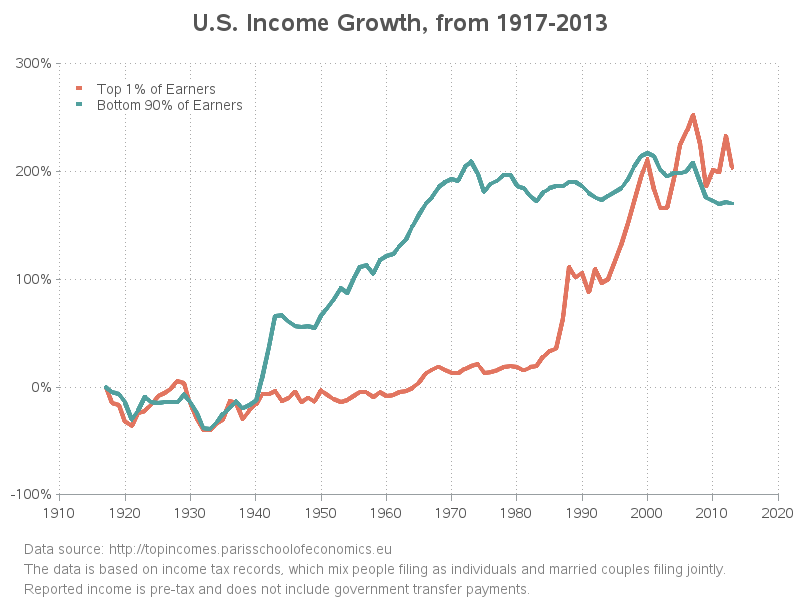

As the figure above reflects, income growth soared for the top 1% of earners while significantly dropping for the bottom 90%. The results should not be too shocking when you reduce taxes for top earners, cut spending for essential programs that promote upward mobility, and corporations fail to deliver the good paying jobs that keep up with the rising cost of living.

The Era of Free Trade

While Reagan completely upended the role of government, he wasn’t alone in reshaping the system to be overwhelmingly in favor of corporate interests. The late 1980s and early 1990s would usher in a new era of free trade, where the promise of cheaper goods and economic growth would outweigh any potential job losses. The Bush and Clinton administrations that succeeded Reagan saw this as a prime opportunity, both supporting the North American Free Trade Agreement (NAFTA) to “eliminate all tariff and non-tariff barriers of trade and investment between the United States, Canada and Mexico.“8 What was thought to be an opportunity of economic cooperation absolutely decimated domestic manufacturing.

In the state of Michigan alone, about 168,403 manufacturing jobs would be lost in the NAFTA era, according to the U.S. Bureau of Labor Statistics.9 Some think tanks may argue that these were just minor job losses and we should pay no mind, but the truth is this line of policy has upended actual lives. Decent paying manufacturing jobs in states like Michigan and across the country were lost, all so that corporations could exploit cheap labor in countries with weaker worker protections. Some of these think tanks may also argue workers can get a new eduction for better paying jobs, yet support the very politicians cutting funding for said education. This is a cycle that reinforces itself.

It became pretty clear that this whole free trade thing wasn’t going to work out for everybody. As the country entered the new century, President George W. Bush still maintained free trade was the way. President Bush would sign off on a proclamation granting China permanent normal trade relations status and praised their 2001 entry into the World Trade Organization (WTO).10 This was also supported by President Clinton, who believed trade could one day lead to democracy in China. Instead, millions of jobs were lost due to competition with China, with about 1 million manufacturing jobs accounting for this loss.11 Supporters of free trade commonly argue that the lower prices from Chinese imports outweigh whatever job losses occurred. These lower prices are rooted in underpaid labor out of China, often with crueler working conditions. This may have generated job opportunities in China, but there are certainly better ways to lift individuals out of poverty than with low-paying, abusive work environments. Democracy certainly did not come to be in China either. This was an act that ultimately legitimized the authoritarian regime in China, put millions of Americans out of work, and standardized underpaid labor as a policy solution for poverty. Not to mention, these cheaper goods were lower quality compared to the higher-paid, unionized labor that produced them before. Quality goods only come from the proper treatment of workers and the U.S.-China trade story is clear evidence of this.

The Backlash

The people eventually felt the pains of the system. Nothing was effectively done to truly alleviate job losses across the United States. This fueled Donald Trump’s election to the White House in 2016, with him sweeping the key manufacturing swing-states of Pennsylvania, Michigan, Wisconsin, and Ohio. Beyond manufacturing towns, many Americans across the country just felt they could no longer get ahead. Trump was the first major U.S. presidential candidate to exploit the consequences of modern free trade as a means for political victory, taking a page from Ross Perot. He had convinced his supporters he would fight for the workers who had lost their jobs. Voters perceived him as different from the other politicians, someone who would stand up to the corporations sending their jobs away. However, when push came to shove, Trump also bent the knee.

Trump’s major policy accomplishment in his first term was the 2017 Tax Cuts and Jobs Act (TCJA). This piece of legislation promised businesses would be incentivized by major tax cuts to create new jobs through investment, just like what Reagan had proposed decades prior. TCJA reduced the corporate tax rate from 35% to 21%.12 There were also some middle-class tax cuts in this, but these were quite little. In fact, households with incomes in the bottom 60% only received an average tax cut of less than $500, compared to the more than $60,000 in average cuts for the top 1% of earners.13 This act did jack for the working and middle classes, but it sure helped out the wealthy elites. Trump was clearly not going to be much different from previous leaders in kissing the ring of corporate interests, despite all the tough talk on the campaign trail. He bashed his predecessors as establishment sellouts, but followed the same playbook of cutting taxes for huge corporations.

Many working and middle class supporters of the 45th (and soon, 47th) President were willing to look past the corporate tax cuts, if these at least meant they would get some jobs. He would start by negotiating the United States–Mexico–Canada Agreement as a replacement for NAFTA (we’ll dive deeper into this in a future post), as well as pulling out of the Obama-era Trans-Pacific Partnership (TPP) free trade agreement. However, the work continued to leave. From January 2017 to June 2020, Trump’s Labor Department certified 1,996 petitions related to companies going overseas, with 184,888 jobs leaving the United States. This surpassed the Obama Presidency, which saw 1,811 petitions certified and 172,336 jobs impacted.14 Trump proved he would be no different than Obama, Bush, or Clinton in overseeing offshoring. In the end, Trump cut taxes for massive corporations and allowed for thousands of jobs to be sent away for cheaper labor. It should come as no surprise this happened, considering Trump also sold a lot of his own foreign-produced goods.

From eyeglasses produced in China, to ties made in Vietnam, Trump certainly comes off as hypocritical in attacking big corporations for outsourcing when he follows the same business practices.15

The Solution

The solution to decades of war waged on the working-class is a complete restructuring of economic policy in the United States. No, I’m not saying we need to become a Communist system. I’m arguing that we need to create a system where everyone has an equal shot at achieving the American Dream. The system I’m in favor of actually existed for a good portion of the post-WWII Era, specifically between 1940 to 1980. Corporations paid their fair share in taxes, labor unions were still strong, and people were actually able to build their wealth. Middle-class Americans who already have a decent life feel that such efforts of reform would harm their standing, but they would actually be even wealthier if we still had the system that existed then. In fact, we all would be. We can lift people out of homelessness, working-class individuals would thrive instead of barely getting by, and middle-class folks with a decent standard of living would be able to expand their wealth. When we concentrate so much wealth in the very few, we limit the potential earnings the rest of us can make. There is a cap put on the American Dream, and instead of some Communist regime dictating resources, we are at the mercy of Elon Musk and other billionaires who essentially run a command economy. This means more corporate tax cuts and weaker protections for labor, denying millions of Americans a pathway to the American Dream. This is also an assault on free enterprise, as those at the top will fix the rules of the game so absolutely no one can compete with them (otherwise known as monopoly).

I won’t make this article any longer than it needs to be, but my future posts will delve deeper into the specific issues and solutions. I will leave you with a starting point, which is President Franklin D. Roosevelt’s Bill of Economic Rights, which proposed a framework to ensuring every American had a shot to achieving the American Dream. Some of these rights included the guaranteed right to a job that paid enough to live off of, the right of entrepreneurs to start their own business without having to compete with monopolies, the right to good medical care, and the right to a home.16 These reforms were never meant to be handouts. Roosevelt wasn’t proposing free mansions for people who put in no work. He meant safe, affordable housing for people so that they do not die on the streets. You were guaranteed a safe starting point, but it was up to you to build and expand wealth with the fair shot provided by this Bill of Rights. If you lost your job or your business, this system allowed for you to get right back up and take another shot at the American Dream. That’s all it really is about, ensuring people have the ability to climb to new heights and be rewarded for the hard work they put in, without being utterly screwed if things take even the slightest wrong turn. This is the first step we can take to fixing our broken system.

https://www.reuters.com/markets/us/us-third-quarter-economic-growth-revised-higher-2024-12-19/

https://hbr.org/2019/10/gdp-is-not-a-measure-of-human-well-being

https://www.census.gov/content/dam/Census/library/publications/2019/demo/p60-266.pdf

https://www.brookings.edu/articles/what-we-learned-from-reagans-tax-cuts/

https://www.forbes.com/sites/taxnotes/2021/09/03/reagans-tax-cut-just-turned-40---and-its-still-the-most-important-tax-reform-since-world-war-ii/

https://www.pbs.org/newshour/economy/column-how-reaganomics-deregulation-and-bailouts-led-to-the-rise-of-trump

https://www.irp.wisc.edu/publications/focus/pdfs/foc52b.pdf

https://www.federalregister.gov/north-american-free-trade-agreement-nafta-#:~:text=The%20agreement%20came%20into%20force,View%203889%20more%20results.

https://www.citizen.org/article/michigan-job-loss-during-the-nafta-wto-period/

https://georgewbush-whitehouse.archives.gov/news/releases/2001/12/20011227-2.html

https://education.cfr.org/learn/reading/what-happened-when-china-joined-wto

https://about.bgov.com/insights/elections/2025-tax-policy-crossroads-what-will-happen-when-the-tcja-expires/#:~:text=The%20TCJA%2C%20passed%20by%20a,expanded%20the%20child%20tax%20credit.

https://www.cbpp.org/research/federal-tax/the-2017-trump-tax-law-was-skewed-to-the-rich-expensive-and-failed-to-deliver#_edn1

https://www.bloomberg.com/news/newsletters/2020-10-22/supply-chains-latest-the-hard-data-on-trump-s-offshoring-record

https://www.nbcnews.com/politics/donald-trump/trump-event-touted-made-america-goods-lot-his-merchandise-couldn-n893656

https://www.ushistory.org/documents/economic_bill_of_rights.htm?srsltid=AfmBOor_LSN8JOgoB5UMBhG0eFvAKgeJJ_c6nlMxUSzakuTDcm1_kuCx