Clinton's Fatal Error

How the seeds for the 2008 financial crisis were planted under the Clinton administration.

The 2008 housing market collapse was one of the biggest financial disasters in our nation’s history. Although recessions and downturns are natural for any economy, this one proved to be the worst since the stock market crash of 1929. Wall Street imploded, millions lost their jobs, and the promise of the American Dream was once again under a great test. But where did everything go wrong?

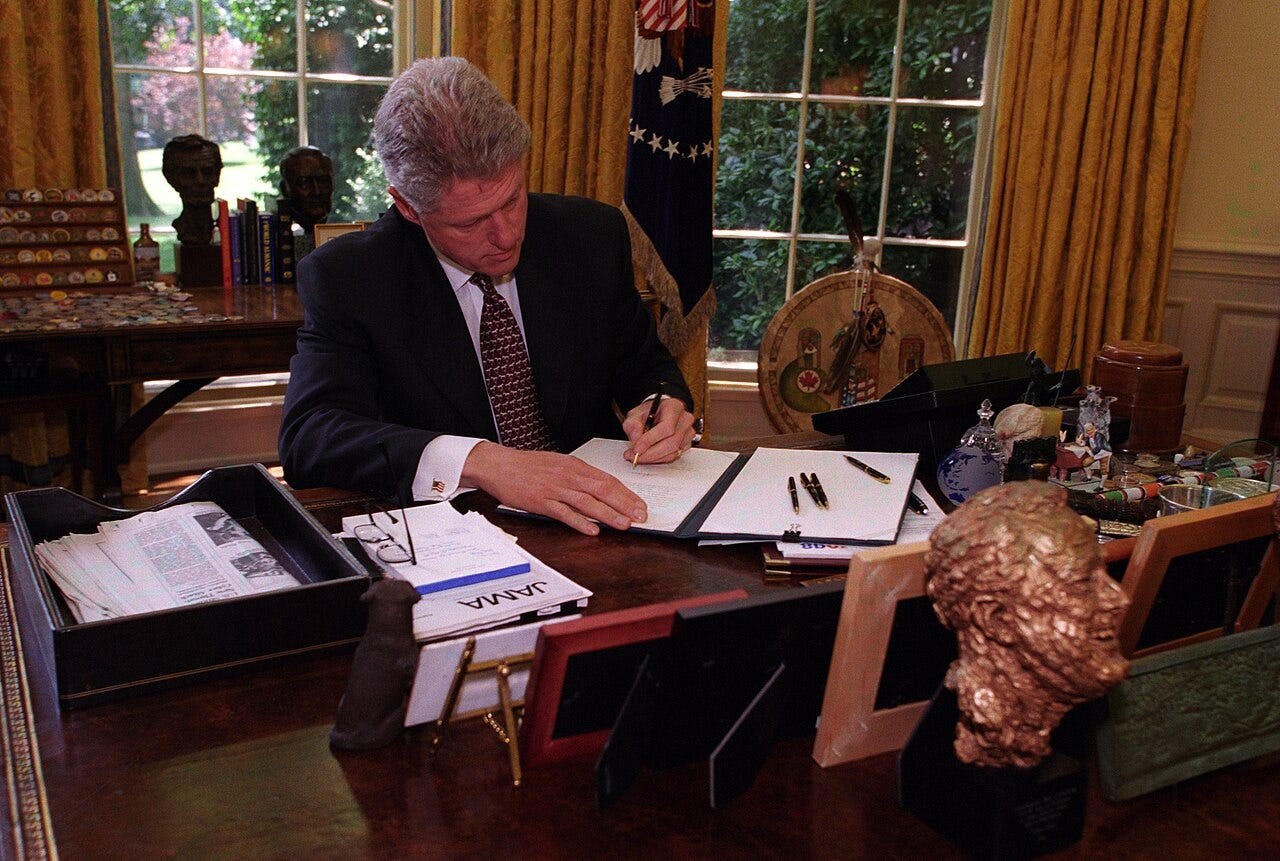

Although the 2008 Great Recession occurred under the George W. Bush administration, the seeds of what caused the collapse were planted roughly a decade earlier during Bill Clinton’s presidency. Of course, Bush’s mismanagement of the economy during the 2000s certainly played a major role in the collapse, but it was actually President Clinton who signed off on a critical piece of legislation that put the gears in motion for this historic downturn.

The Financial Services Modernization Act of 1999

In November 1999, President Bill Clinton signed the Financial Services Modernization Act of 1999—also known as the Gramm-Leach-Bliley Act (GLBA)—into law. The major highlight of GLBA was how it repealed significant portions of the 1933 Glass-Steagall Act. Signed into law by President Franklin D. Roosevelt, the Glass-Steagall Act “…effectively separated commercial banking from investment banking and created the Federal Deposit Insurance Corporation.”1 This early 1930s legislation came about as an effort to restore faith in the American banking system during the first few years of the Great Depression. Federal Reserve History offers a solid explanation of what this act accomplished:

“Basically, commercial banks, which took in deposits and made loans, were no longer allowed to underwrite or deal in securities, while investment banks, which underwrote and dealt in securities, were no longer allowed to have close connections to commercial banks, such as overlapping directorships or common ownership.”2

If you read my previous article about Elon Musk and The Big Short, you’ll remember how I warned Musk’s effort to dismantle key financial regulatory agencies could lead to the very economic conditions that allowed for the 2008 housing market collapse. Well, Glass-Steagall sought to prevent something like this from happening. If Clinton had not signed Gramm-Leach-Blilely into law, commercial and investment banking would have remained separated, which likely would have blunted the disaster that was 2008. Commercial banks such as Citibank and Bank of America would have been significantly limited in their exposure to the risky mortgage market that was taking shape on Wall Street. Former U.S. Department of Labor Secretary Robert Reich explained to The Atlantic his argument for why dismantling Glass-Steagall significantly contributed to the Great Recession in one 2016 article:

“Some argue Glass-Steagall wouldn’t have prevented the 2008 crisis because the real culprits were non-banks like Lehman Brothers and Bear Stearns. But that's baloney. These non-banks got their funding from the big banks in the form of lines of credit, mortgages, and repurchase agreements. If the big banks hadn’t provided them the money, the non-banks wouldn’t have got into trouble. And why were the banks able to give them easy credit on bad collateral? Because Glass-Steagall was gone.”3

Bank executives often argue that reviving Glass-Steagall isn’t necessary because none of the banks “actually ended up failing.” Reich also responds to this claiming, “This is like arguing lifeguards are no longer necessary at beaches where no one has drowned. It ignores the fact that the big banks were bailed out.”4 In Reich’s view, had there still been a separation of commercial and investment banking, we likely would have avoided a taxpayer bailout of the big banks.

Reich isn’t alone in this argument. Economist Joseph Stiglitz agreed with this assessment in a 2009 lecture that was later published by Columbia Business School:

“Investment banks are designed to manage rich people’s money, and commercial banks are the payment mechanism of our economy. Commercial banks should be conservative, since they are taking and managing ordinary people’s money, which should be managed conservatively. People who are wealthy can gamble and take greater risks through investment banks. However, merging these two not only created a whole set of conflicts of interest but also increased the number of banks that are too big to fail. The mergers spread the culture of risk-taking that had dominated investment banks to the whole financial system.”5

It was a critical error for President Clinton to allow the risk-taking behavior of investment banks to merge with the everyday banking services used by Americans. Thus, by significantly repealing Glass-Steagall, the U.S. government allowed Wall Street to gamble with the money of Main Street. President Clinton was not alone in this error. It should be noted nearly every single Senate Republican voted for Gramm-Leach-Bliley (except one who opposed), along with the vast majority of Senate Democrats (barring seven who voted against it).6 Even President Obama, who campaigned on populist promises to restore order to America’s banking industry, ended up opposing a restoration of Glass-Steagall during his administration. Instead, Obama’s banking regulation bill “…went along with the desire of Wall Street lobbyists to prevent the breakup of the big conglomerates and to block control of their massive trading in the derivatives that proved to be so toxic.”7 Instead, we got the Dodd–Frank Wall Street Reform and Consumer Protection Act.

Dodd-Frank didn’t go far enough

A Council on Foreign Relations brief details some of Dodd-Frank’s basic provisions, which “…restricted banks from trading with their own funds (the “Volcker Rule”), heightened monitoring of systemic risk, tightened regulation of financial products, and introduced consumer protection initiatives.”8 While these measures sound promising on paper, a deeper understanding of the act’s legal structure renders it less effective than Glass-Steagall.

A 2016 briefing from the Congressional Research Service made clear the distinction between Glass-Steagall and Dodd-Frank. The report states, “The Dodd-Frank Act neither reinstated the sections of the Glass-Steagall Act that were repealed by GLBA nor substantially modified the ability of banking firms to affiliate with securities firms.”9 Although it did not fully separate commercial and investment banking, its provisions attempted to reduce speculative securities-related activities of commercial banks and other sources of financial instability.10 Yet, despite the reforms associated with Dodd-Frank, its legal structure still leaves Main Street vulnerable. This analysis is supported by Cornell Law School Professor Saule Omarova’s 2011 report detailing the limitations of Dodd-Frank:

“The Dodd-Frank Act misses the target... It purports to expand the scope of the existing limitations on bank affiliate transactions but does not change the fundamental dynamics of the regulatory decision making in times of crisis. Even assuming that the Act's provisions will technically strengthen the statutory firewall in times of calm, nothing in the Act guarantees that this newly enhanced firewall will withstand the next systemic crisis.”11

Professor Omarova further argues in her report that, “One such potential solution may be returning to the old Glass-Steagall principle of institutional separation among different classes of financial institutions.”12 While Dodd-Frank made some attempts to reinstate regulatory provisions that existed prior to the Clinton-era deregulation, there is concern the structures of separation it implemented are not nearly enough. Indeed, Omarova’s analysis further supports the argument that the Gramm-Leach-Bliley Act was a critical error of the Clinton administration.

It’s time to reinstate Glass-Steagall

We need to learn from the mistakes of the 2008 financial crisis, going all the way back to the destabilizing measures undertaken by the Clinton administration. The best way to secure the future of our nation’s banking system is to ensure a concrete wall exists between investment banks and commercial banks. Unfortunately, this is unlikely to come anytime soon. Despite President Trump even calling for the reinstatement of Glass-Steagall in his 2016 campaign,13 this never came to be in his first term. Not only that, his first Treasury Secretary confirmed President Trump’s opposition to reinstating the New Deal-era legislation. Former Treasury Secretary Steve Mnuchin stated during a 2017 Senate Banking Committee hearing, on behalf of the Trump administration, “We do not support a separation of banks and investment banks.”14 If anything, the first Trump presidency oversaw significant rollbacks of banking regulations. In his changes, President Trump raised the threshold from $50 billion to $250 billion “…under which banks are deemed too important to the financial system to fail.”15 His rollbacks of Dodd-Frank also eased mortgage loan data reporting requirements for the overwhelming majority of banks16 and exempted banks with less than $10 billion in assets from the Volcker Rule.17

From Clinton to Trump, we have seen a failure to keep the banking system in check. Clinton planted the seeds for collapse and Obama caved to the interests of Wall Street in failing to restore Glass-Steagall. Trump, like any other politician, flip-flopped from supporting the legislation on the campaign trail to straight up rolling back its watered-down replacement. It may unfortunately take another major financial meltdown before politicians finally embrace the interests of Main Street over Wall Street.

https://www.federalreservehistory.org/essays/glass-steagall-act

Ibid.

https://www.theatlantic.com/business/archive/2016/08/glass-steagall/496856/

Ibid.

https://business.columbia.edu/sites/default/files-efs/imce-uploads/Joseph_Stiglitz/2010_Lessons_Global_Financial_Crisis_Seoul.pdf

https://www.senate.gov/legislative/LIS/roll_call_votes/vote1061/vote_106_1_00354.htm?utm_source=chatgpt.com

https://www.thenation.com/article/archive/mccain-gets-it-obama-doesnt/

https://www.cfr.org/backgrounder/what-dodd-frank-act

https://www.congress.gov/crs product/R44349#:~:text=How%20Might%20the%20Absence%20of,and%20securities%20activities%20gradually%20eroded.

Ibid.

https://scholarship.law.cornell.edu/cgi/viewcontent.cgi?article=2486&context=facpub

Ibid.

https://www.reuters.com/article/economy/trump-calls-for-21st-century-glass-steagall-banking-law-idUSKCN12Q2WX/

https://morningconsult.com/2017/05/18/administration-doesnt-support-glass-steagalls-return-mnuchin-says/

https://www.cnbc.com/2018/05/24/trump-signs-bank-bill-rolling-back-some-dodd-frank-regulations.html

Ibid.

https://www.cfr.org/backgrounder/what-dodd-frank-act